Find insurance coverage for all your needs

Personal insurance

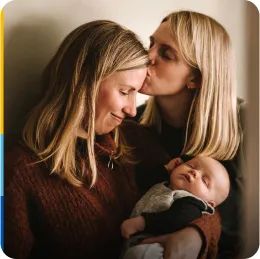

Personal insurance helps protect your finances against life’s uncertainties, especially when someone depends on you financially. Whether you’re buying a home, getting married, or welcoming a new baby, our coverage options are tailored to protect what’s most important to you.

Savings offer!

Save by combining home and auto insurance

Save up to 10% when you insure your main residence and personal vehicle(s) today.

Already a client?

Learn more about how you can manage your insurance policy online. Looking to make a claim? No problem, we’ve made our claims process simple, fast, and easy to do online.

Make a claim with our easy online process

Save time by submitting your insurance claim online. Just follow a few simple steps to get back to your days with peace of mind.

Calculate how much insurance you need

Curious about the right amount of coverage you need? Our calculators can generate a recommendation for you in seconds.

-

Life insurance calculator

-

Disability insurance calculator

-

Annuity calculator

-

Critical illness calculator

Manage your insurance policies online

Conveniently access, review and manage your home, auto, life and health insurance policies anywhere, anytime.

Whatever your needs, we can help.

Call an RBC Insurance Advisor today or request an advisor contact you.

or

Call 1-800-769-2568

Learn more about insurance

Learn how insurance works to help you get what you need—and avoid what you don’t.

Seven Ways to Save Money on Car Insurance

Here are some helpful tips that can help you save money on your car insurance.

Three Things To Do Before You Buy Life Insurance

Shopping for life insurance can feel intimidating at times — but a little preparation can go a long way. Here are 3 tips to get you started.

Nine Ways to Save on Home Insurance

Here are nine ways to help you get the home insurance coverage you need, at a price you can afford.

All savings opportunities are based on filed discounts and rates in force and vary based on each individual’s insurance profile and are not guaranteed. Savings also vary by the province or territory you live in. Certain conditions, limitations and exclusions may apply. The bundle and save discount also excludes endorsements (any additional, usually optional, enhancements that you add to your policy). For detailed information about how savings could apply to you, speak with a licensed RBC Insurance advisor.

The home security system discount through RBC Insurance is not available in Ontario, Alberta or British Columbia and is not applicable to condo and tenant insurance policies. There are specific eligibility requirements to qualify for the home security discount.

All savings opportunities are based on filed discounts and rates in force and vary based on each individual’s insurance profile and are not guaranteed. Savings also vary by the province or territory you live in. Certain conditions, limitations and exclusions may apply. The bundle and save discount also excludes endorsements (any additional, usually optional, enhancements that you add to your policy). For detailed information about how savings could apply to you, speak with a licensed RBC Insurance advisor.

All terms and conditions are contained in the applicable insurance policy. Home and auto insurance products are distributed by RBC Insurance Agency Ltd. and underwritten by Aviva General Insurance Company. In Quebec, RBC Insurance Agency Ltd. Is registered as a damage insurance agency. As a result of government-run auto insurance plans, car insurance is not available through RBC Insurance in Manitoba, Saskatchewan and British Columbia.

NMG Consulting Canadian Individual Life Insurance Study 2022 Investment Executive Insurance Advisors’ Report Card