Home > Retirement >

“I want to grow and protect my money”

Segregated Funds–such as RBC Guaranteed Investment Funds (GIFs)–offer unique benefits that can help you reach your retirement goals.

Segregated funds

Benefits of segregated funds

Your one-stop shop for segregated funds

It’s easy to get started

Start investing with as little as $50 per month when you set up a pre-authorized debit (PAD) plan.

Choose your accounts

You can hold RBC GIFs in an RRSP, TFSA, non-registered plan, locked-in plan, RRIF or LIF. Access your money at any time.1

Selection of funds

Choose from 28 individual Guaranteed Investment Funds (including money market, balanced, fixed income and equity funds) and 8 portfolio solutions.

Simplify your investing

RBC Select Guaranteed Investment Portfolios (GIPs) are professionally managed and designed to give you the right asset mix for your needs.

Reach your financial goals with an RBC GIF Series

Segregated funds

Invest series

Higher opportunity for growth combined with lower fees. Perfect if you want to grow your money and don’t need maximum guarantees.

Right choice if you:

Are looking for long-term growth and flexibility from your investments

Are saving for retirement or another future goal

Want to protect your money but don’t need maximum guarantees

Want to diversify your investments

Are interested in creditor protection

Segregated funds

Most popular

Series 1

Protect your money with extra guarantees. A great choice if you’re not much for risk and/or you’re planning your estate.

Right choice if you:

Want to reduce risk and protect your money against dips in the market

Are saving for retirement or another future goal

Want to pass on as much as possible to your loved ones

Want to diversify your investments

Are interested in creditor protection

Segregated funds

Most popular

Series 2

The highest level of protection with the option to lock in your money if the fund value goes up. Ideal if you want growth without the risk.

Highlights

Maturity guarantee1: 75% of your deposit or the market value2, whichever is higher after 10 years

Death benefit guarantee1: 100% of your deposit before age 80 (80% after age 80) or the market value2, whichever is higher

Option to reset every year until age 90

Choice of 11 individual funds and 8 portfolio solutions

Right choice if you:

Want to lock in investment growth when markets go up

Prefer to reduce risk and protect your money against dips in the market

Want to pass on as much as possible to your loved ones

Are saving for retirement or another future goal

Are interested in creditor protection

RBC GIF information and financials

Information folder & contract

Fund prices and performance

Check fund prices and performance from Lipper.

Frequently asked questions about segregated funds

You can start investing in an RBC Guaranteed Investment Fund (GIF) for as little as $50 per month when you set up a pre-authorized debit (PAD) plan.

You can hold RBC Guaranteed Investment Funds (GIFs) in a number of account types, including Registered Retirement Savings Plans (RRSPs), Tax-Free Savings Accounts (TFSAs), non-registered plans, locked-in plans and Registered Retirement Income Funds (RRIFs).

If a segregated fund has a “reset” option, you can reset the guaranteed value of your contract when the market value becomes higher than the original value (or “book value”) of your investment. This reset function allows you to keep pace with market growth. Generally, when the reset feature is used, the maturity date will also be reset.

The Invest Series, Series 1 and Series 2 have different options and features to meet different investment needs and goals. Take a look at our comparison chart to see what each one offers.

RBC Guaranteed Investment Funds (GIFs) and RBC Select Guaranteed Investment Portfolios (GIPs) are available in three different series—Invest Series, Series 1 and Series 2—each designed to help meet various investing goals. A licensed RBC Insurance Advisor can help you determine which series—or combination of series—is right for you.

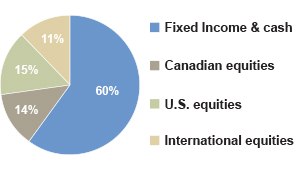

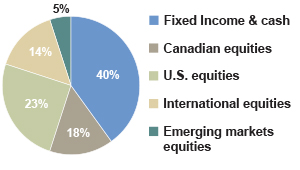

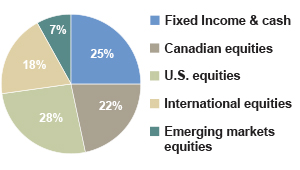

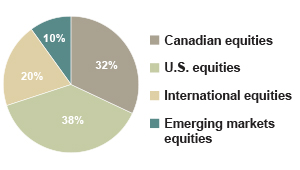

Portfolio solutions, such as RBC Select Guaranteed Investment Portfolios (GIPs) are designed to provide the right asset mix to meet your risk profile and investment objectives. Each RBC Select GIP is actively monitored and rebalanced by RBC Global Asset Management to ensure your investments remain on track. There are 4 RBC Select GIPs available, so whether you’re a conservative investor or more growth-oriented, you’re sure to find a portfolio that meets your needs.

Yes. Segregated funds are actually ideal investment solutions for individuals who don’t qualify for life insurance. That’s because they offer death benefit guarantees that ensure your beneficiaries will receive a guaranteed percentage of your original investment (less any withdrawals and fees) upon your death. There is no medical checkup or underwriting required.

Yes, you can withdraw from a segregated fund before the maturity date, however your guarantees will be affected. They will be proportionately reduced by any withdrawals or fees applicable to the withdrawal.

Will be reduced proportionately for all withdrawals and fees.

Please refer to the information folder and contract to understand how the guarantees work.

Please contact your advisor if you require copies of previously published Financial Statements and/or Fund Facts.

Any amount that is allocated to a segregated fund is invested at the risk of the contract holder and may increase or decrease in value. RBC Guaranteed Investment Funds are individual variable annuity contracts and are referred to as segregated funds. RBC Life Insurance Company is the sole issuer and guarantor of the guarantee provisions contained in these Contracts. The underlying mutual funds and portfolios available in these Contracts are managed by RBC Global Asset Management Inc. Details of the applicable Contract are contained in the RBC GIF Information Folder and Contract.

The current interest rate is in effect as of October 31, 2025.

The interest rate is an annual interest rate. It is a simple interest calculation. Interest is calculated daily on the balance and paid monthly. Interest rate is subject to change at any time without notice.