5 ways to save on life insurance

(without compromising your coverage)

Insider tips used by licensed insurance professionals

Are you looking for a life insurance policy that gives you the best coverage for the lowest possible price?

Knowing where to look and what questions to ask is half the battle.

Instead of re-hashing common life insurance advice, this guide shares actionable insider tips and tricks that professional insurance brokers and advisors use to save money while getting the coverage their clients need.

Get a life insurance quote that you can use to compare with other insurance providers.

Shop smart and compare multiple quotes

Comparing 3–5 quotes from different providers is the best way to ensure you’re getting a good deal.

Professional brokers and advisors use special tools and software to collect and compare quotes from different insurance companies.

Here are three different Canadian online life insurance comparison tools:

-

PolicyAdvisor.com

-

Rates.ca

-

InsuranceHotline.com

Entering your province, gender, age, smoker-status, and email address into any of these platforms will return multiple insurance quotes from the leading Canadian life insurance companies.

(RBC Insurance is not affiliated with these websites, and does not guarantee the results of their use.)

Tailor the quotes based on how much coverage you need, and how long you’d like the coverage to last.

Tip

Use the RBC Life Insurance Calculator to figure out how much coverage is right for you.

We recommend using more than one tool to compare quotes as there might be some variance in the results.

Example: A $500,000 policy for 20 years might cost $35/month, while reducing the term to 15 years drops the premium to $25/month.2

Use strategic policy layering

Many people take out a single life insurance policy that covers all their needs for a fixed term.

But industry professionals often practice policy layering. This refers to the act of buying multiple life insurance policies with different coverage amounts and durations to match your financial needs at specific stages of your life.

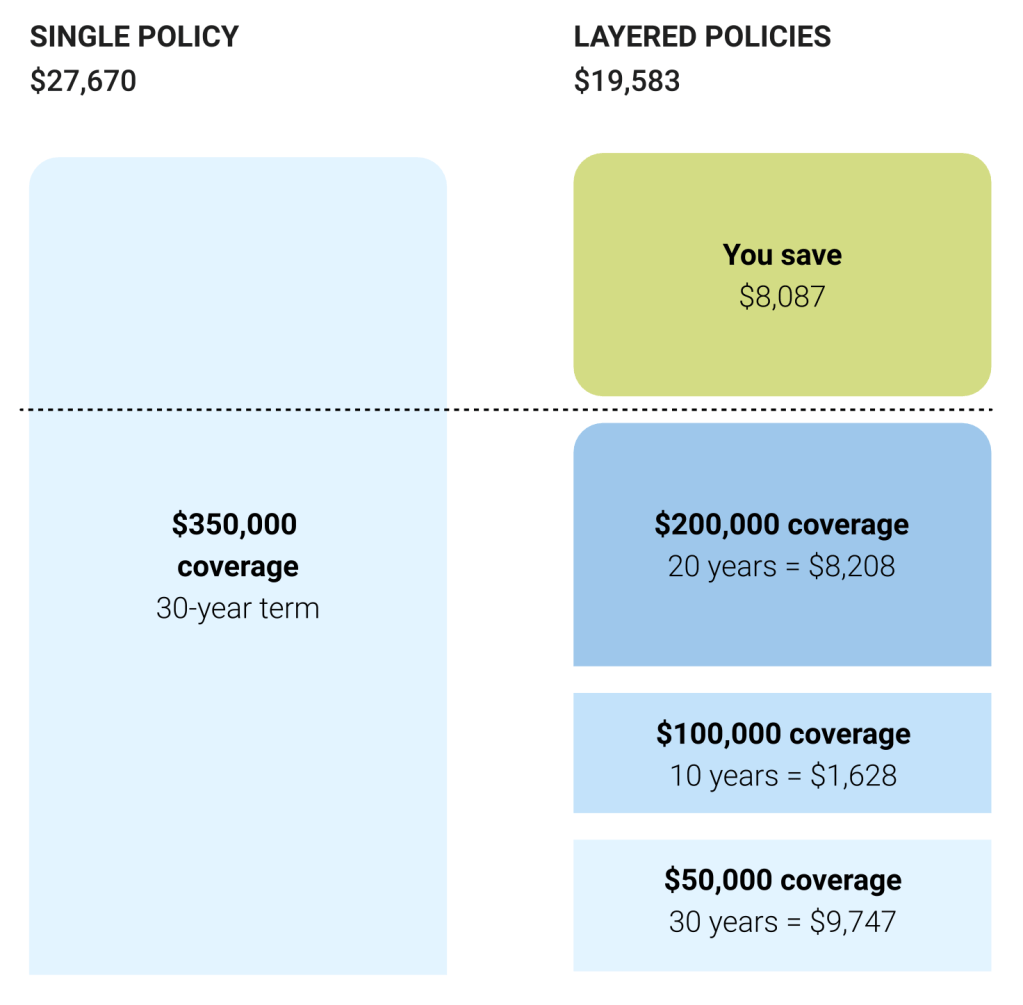

Layer multiple policies for savings

Instead of paying for one large, expensive policy, layering smaller policies that only overlap when necessary can save you money while ensuring you have the right amount of coverage only when you need it.

For example, instead of a single life insurance policy with $350,000 coverage for 30 years, you can take out three different policies to get the same coverage at a lower cost:2

-

Policy 1: $100,000 for 10 years to cover immediate short-term debts like personal loans or car payments

-

Policy 2: $200,000 for 20 years to cover your mortgage

-

Policy 3: $50,000 for 30 years to provide long-term income replacement for your family

Layering your life insurance policies in this way can reduce your overall payments significantly.

Example: Layering $350,000 of term life insurance coverage with RBC Insurance over 30 years into 3 different polices saves nearly 30% on your total premium payments.

Note: Rates and savings are based on a Simplified Term Life policy for a 41-year-old non-smoker male living in Ontario, with premiums paid annually2

How to layer life insurance policies

1. Determine your coverage needs for different life stages and financial obligations

-

Immediate debts: Calculate your total short-term debts like personal loans or car loans (e.g., a 10-year term policy)

-

Mortgage: Align coverage with the remaining years of your mortgage (e.g., a 20-year term policy)

-

Long-term needs: Include income replacement for your dependents, or education costs for kids (e.g., a 30-year term policy)

2. Use a life insurance calculator

-

Search for calculators from Canadian-specific platforms like PolicyAdvisor.com or InsuranceHotline.com

-

Input different policy term lengths and amounts based on your financial breakdown from Step 1

-

For example: Calculate $100,000 coverage for 10 years, $200,000 for 20 years, and $50,000 for 30 years

Tip

Use the RBC Term Life Insurance Tool to quickly create and compare life insurance policy quotes for different coverage amounts and durations.

3. Compare costs to verify savings

-

Add these premiums together to calculate the total cost of layered policies.

-

Use the same calculator to check the premium for a single policy covering the highest amount for the longest period (e.g., $350,000 for 30 years)

-

Compare this total cost to the combined cost of layered policies to confirm savings

Improve health and optimize your application timing

Insurance policy premiums are calculated through underwriting, which is the process insurers use to assess how risky it is to provide you with coverage.

Underwriting looks at factors like your health, age, lifestyle and occupation to decide how much your life insurance policy will cost and whether to approve it.

While you can’t change how old you are, you can change certain lifestyle and health factors to make you less risky (and less expensive) to insure.

Here are two changeable health factors that have a big impact life insurance premiums:

-

Body-Mass Index (BMI)

-

Smoker vs. Non-Smoker

Lower your BMI to reach a healthier range

Insurers often base premiums on BMI (Body Mass Index), a simple calculation that uses a person’s height and weight to designate a classification.

-

Healthy BMI (18.5 – 24.9): Most insurers offer standard or preferred rates.

-

Overweight BMI (25 – 29.9): Standard rates are still available, but preferred rates are less likely.

-

Obese BMI (30+): Insurers may charge higher premiums or impose stricter underwriting requirements. Lowering BMI below 30 can lead to significant savings.

Calculate your BMI

To lower your premiums, focus on reaching a weight that lowers your BMI into the next category. For example, moving from a BMI of 30.5 to 29.9 will drop your insurance premiums from ‘Obese’ category rates into ‘Overweight’, but moving from 29.9 to 24 won’t make you eligible for ‘Healthy’ category rates.

Tip

Ask an insurer what BMI ranges and categories they use when assessing applications.

Quit smoking

In Canada, smokers typically pay 2 to 4 times more than non-smokers for life insurance.

Most insurers classify you as a smoker if you’ve used tobacco or nicotine products in the last 12 months, including vaping and nicotine replacements.

Example: A 35-year-old non-smoker might pay $30 per month for a $500,000, 20-year term life insurance policy. A smoker of the same age and coverage could pay $90-$120 per month.2

Time your application to maximize health improvement savings

If you plan to lose weight or quit smoking, it’s more cost-effective to wait for these health improvements before applying.

Apply six months after achieving significant health improvements to ensure these changes reflect in your medical records and can be used in the underwriting process to secure lower rates.

If you need life insurance coverage sooner, consider getting temporary short-term coverage to avoid overpaying for long-term coverage while waiting for your health factors to improve.

Example: A smoker plans to quit in a year and takes out a $100,000, 1-year term policy at a higher rate (e.g., $50 per month). After successfully quitting, they reapply for a $500,000, 20-year policy as a non-smoker, reducing their monthly premium to $30.2

Target niche providers and specialized policies

While insurance companies provide coverage for all Canadians, some insurers offer specific demographics special offers or lower premiums rates.

-

Young, Healthy Individuals: Premiums are lowest for people in their 20s and 30s with no major health conditions

-

Non-Smokers: Non-smokers pay significantly less than smokers

-

Women: Women typically pay slightly lower premiums due to longer life expectancy

-

Professionals in low-risk occupations: Office workers and other low-risk occupations may qualify for better rates

-

Active, health-conscious individuals: People with excellent health metrics often qualify for preferred rates

-

Seniors seeking simplified policies: Seniors looking for smaller policies typically can access affordable options

If you fall into one of these categories, look for an insurer that offers special deals or programs for your group. Online comparison tools like PolicyAdvisor.com often highlight insurers’ strengths, while visiting an insurer’s website can help identify special rewards programs or rates.

There are several Canadian insurers that serve these demographics well.

-

RBC Insurance: Offers flexible policies with competitive rates for term life insurance (Check our prices)

-

Manulife: Rewards health-conscious individuals through its Vitality program

-

Sun Life: Competitive rates for women and non-smokers, with flexible term options

-

Canada Life: Strong options for seniors with simplified policies

-

Empire Life: Ideal for young, low-risk professionals with competitive rates

-

Industrial Alliance (iA Financial): Focused on fast approvals for simplified and no-medical-exam products

Ask for discounts and advocate for yourself

Asking the right question can unlock savings that you wouldn’t have otherwise known about.

Make sure to ask these questions before purchasing a life insurance policy:

“Can you provide discounts for paying premiums annually instead of monthly?”

Many insurers offer lower rates for annual payments because it reduces their administrative costs.

Example: Switching from monthly to annual premium payments on a $500,000 20-year term life policy from RBC Insurance for a 41-year-old male living in Ontario reduces yearly payments from $636.12 to $589.00.2

“Are there opportunities to reapply for a lower premium if my health improves or I quit smoking?”

Some insurers allow policyholders to undergo a new underwriting process to reflect improved health or lifestyle changes.

“Do you offer any loyalty or bundling discounts if I purchase multiple policies (e.g., home, auto, or additional life insurance)?”

Bundling policies can lead to significant savings across different types of insurance.

“Does your underwriting process consider factors like fitness tracking or preventive health measures?”

Some insurers offer preferred rates or discounts based on evidence of proactive health management, such as fitness tracker data or gym memberships.

“Can you match a competitor’s quote or adjust underwriting decisions for specific health improvements?”

Brokers often negotiate for these adjustments, and you can do the same by providing detailed health records or competitive quotes from other insurers.

How to secure the best life insurance rates

Affordable, high-quality life insurance is achievable with the right strategies, even without a broker.

1. Compare multiple quotes

-

Use platforms like PolicyAdvisor.com or InsuranceHotline.com to get at least 3-5 different quotes

-

Toggle coverage amounts and term lengths to find the most cost-effective options

2. Consider policy layering

-

Break coverage into multiple term policies to match your financial needs at different life stages

-

Use calculators to estimate costs and confirm layering saves money over a single large policy

3. Improve your health before applying

-

Work on lowering your BMI so it falls into a lower-risk category

-

Wait at least 6 months after significant health improvements to apply

-

If you plan to quit smoking or lose weight, take out a short-term policy now and reapply for a longer-term lower-risk policy once you qualify

4. Target niche providers

-

Identify insurers specializing in your demographic, like young families, professionals, or non-smokers

-

Review their terms and compare against broader market options

5. Advocate for discounts

-

Ask about annual payments discounts, bundling opportunities, or matching competitor quotes

-

Provide evidence of health improvements to negotiate better rates

Tools and resources

Life insurance calculator

Figure out exactly how much life insurance coverage you need in 5 minutes or less.

Term Life insurance quote tool

Get an instant quote on a term life insurance policy from RBC Insurance that you can use to compare with other insurance providers.

Advisor locator

Ask your local RBC Insurance advisor about discounts, bundling opportunities or matching a quote.

3 reasons to choose RBC Insurance

Strong and stable

With over 4.8 million insured clients, we’re one of the largest bank-owned insurance companies in Canada.

Great value

We offer over 20 life, health, home, auto, travel and wealth insurance options to help you protect what matters most.

Trusted advice

All our insurance professionals are extensively trained and licensed to give you clear advice that fits your needs.

On this page

Need more help?

Call an RBC Insurance advisor now at 1-866-223-7113, or request a call and we’ll get back to you within 2 business days.

Underwritten by RBC Life Insurance

All rates, prices, and estimates are for informational purposes only, and are not guaranteed and subject to change at any time