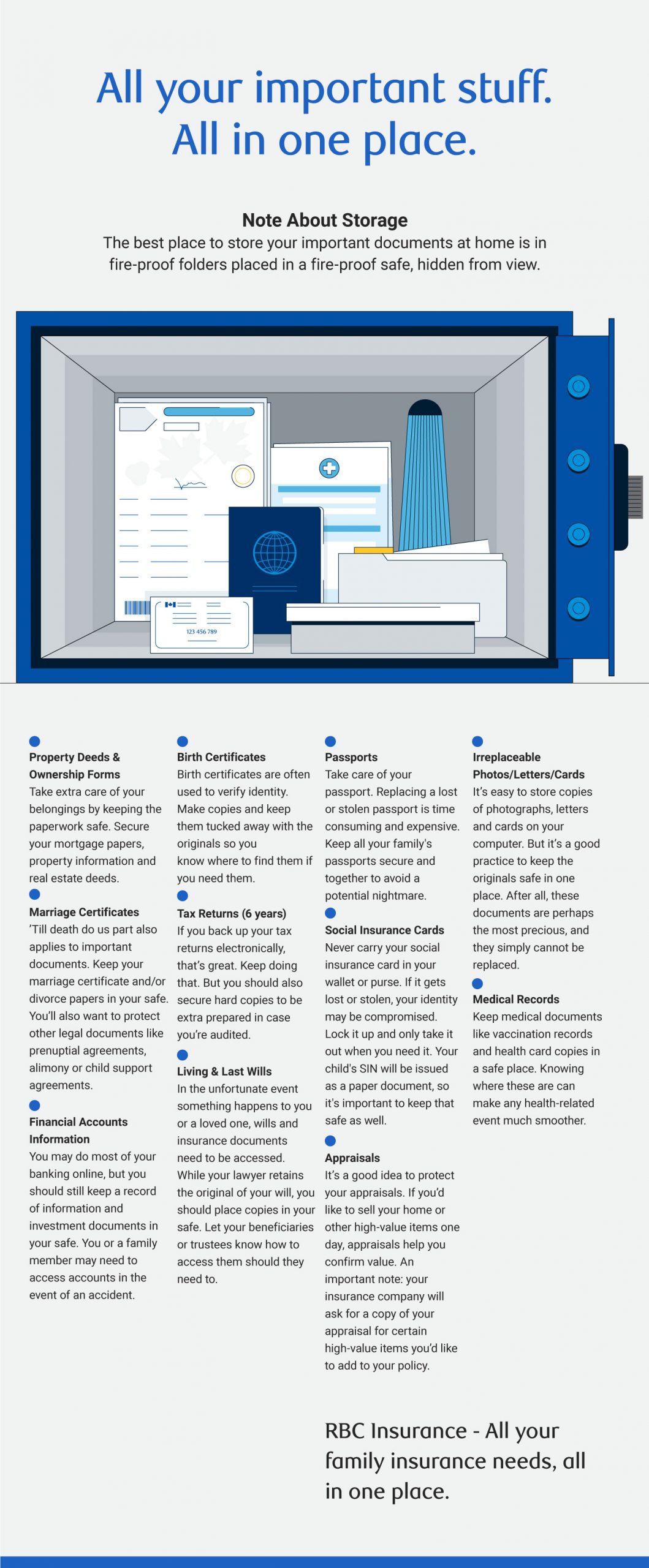

When it comes to insurance, everyone’s needs are different and those needs change as we age. That’s why it’s so important to have professional guidance that can help you make sense of how best to protect you and your family.

The good news is that we can help you from the comfort of your home.

The first step is to request an appointment, which can be done here.

Once the appointment request form is completed, you’ll be matched with an advisor, according to your location and insurance needs.

Next, your advisor will contact you over the phone or by e-mail to set up your first meeting. Usually, that initial conversation is over the phone, although you can request a video call, if you prefer.

There are a few important steps you’ll want to take before your meeting. To make it easy, we’ve put together a helpful checklist that you can use to get ready. It’s designed to help you do your research before the meeting and to guide the conversation itself.

Find our Check-in Checklist here.

Whether you might have an idea of what you want to protect, or no idea at all, talking to an advisor is the first step.

In your first meeting, your advisor will want to get to know you so they can develop a personalized plan that best suits your needs. The advisor will provide information, guidance and advice, so you’ll have what you need to make an informed decision about how to protect yourself and your family, without feeling obligated to purchase. It’s always a good time to think about how you can protect yourself and your family.

Book your appointment with an RBC Insurance advisor today.

RBC Insurance

We make it easy to find expert advice, money-saving tips, and a range of insurance options for every moment of life.

*Home and auto insurance products are distributed by RBC Insurance Agency Ltd. and underwritten by Aviva General Insurance Company. In Quebec, RBC Insurance Agency Ltd. Is registered as a damage insurance agency. As a result of government-run auto insurance plans, auto insurance is not available through RBC Insurance in Manitoba, Saskatchewan and British Columbia.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Share This Article

Read This Next