More Canadians now perceive mental illness as a disability

By RBC Insurance • Published February 1, 2022 • 5 Min Read

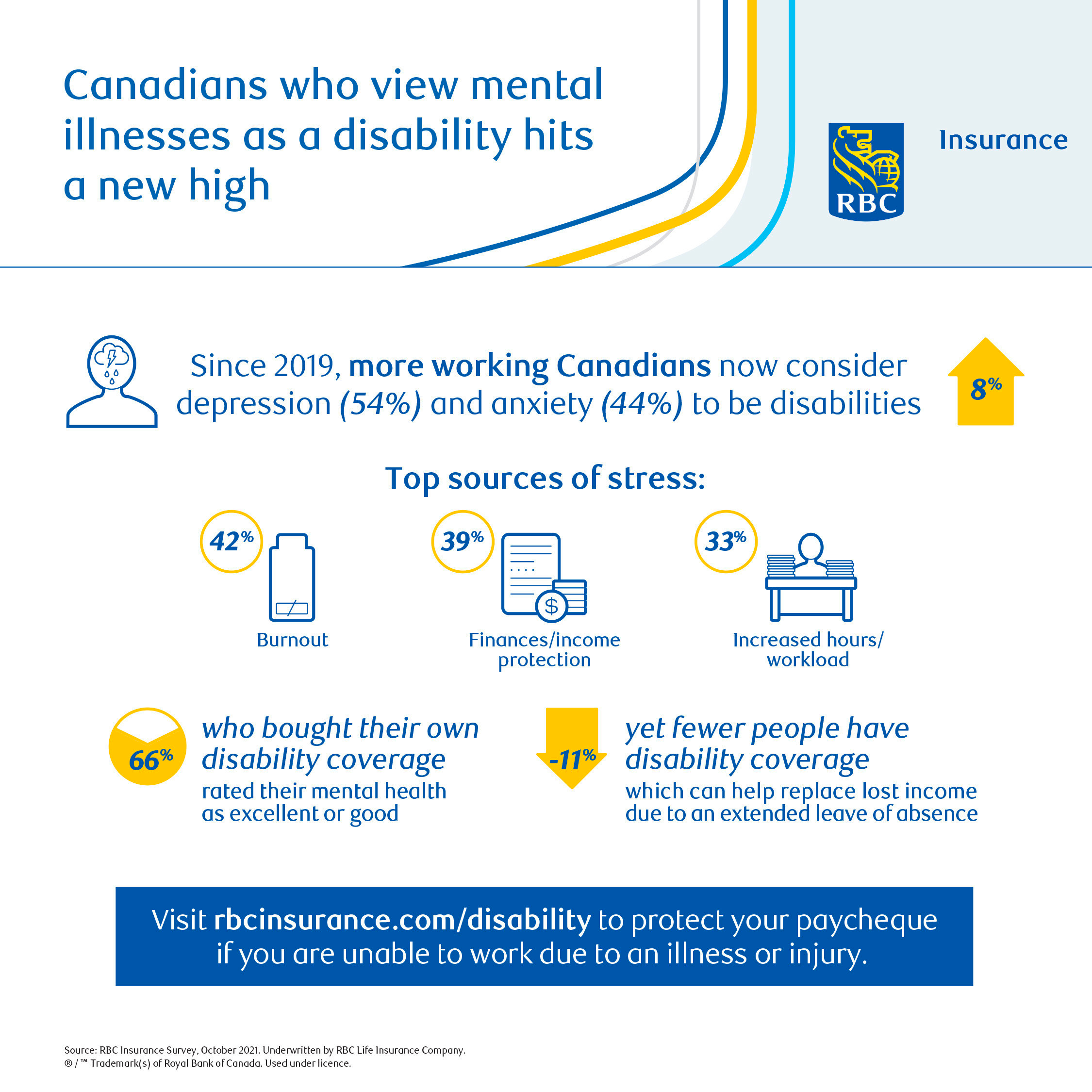

TORONTO, Feb 1, 2022 – As attitudes around health and wellness among employees and employers continue to shift, the number of working Canadians who view mental illnesses as a disability has hit a new high. According to a recent RBC Insurance survey, more Canadians now consider depression (54 per cent) and anxiety (44 per cent) to be disabilities, the highest figures respectively since 2019. At the same time, just over half (54 per cent) rate their mental health as excellent or good, which is a significant drop of 12 percentage points over that same period in 2019.

“Over the years, we have seen more and more Canadians recognizing that disabilities can be mental, and not just physical in nature,” says Maria Winslow, Senior Director, Life & Health, RBC Insurance. “This is an important shift, particularly as people continue to deal with the ongoing stresses of the pandemic and they continue to report a decline in their mental health.”

Significantly more respondents aged 18-34 logged mental health challenges (69% anxiety, 59% depression) compared to those 55 and older (42% and 29% respectively), which Winslow adds could highlight that pandemic-related stressors have had a particularly negative impact on younger people. These findings support actual claims trends among RBC Insurance clients; over one-third (35 per cent) of new individual long-term disability claims for younger clients (18-39) are related to mental health in 2021, which is trending upward since 2019.

The importance of mental health to overall wellbeing is further underscored by survey results that found Canadians reporting poor mental health (32 per cent) were more likely to take time off due to disability than those who report good mental health (12 per cent). Among working Canadians, feelings of burnout were the main source of stress (42 per cent), indicating the potential impacts of the pandemic such as fear, uncertainty, and instability around work and home life. Finances, and income protection if they get sick or have COVID-19 was the second highest stressor for nearly as many (39 per cent), followed by increased work hours/workload (33 per cent).

However, feelings of stress or anxiety were significantly lower among those with support in place; Canadians who had a group benefits plan (60 per cent) and bought their own disability coverage (66 per cent) were more likely to rate their mental health as excellent or good. Still, those who rated their mental health as excellent or good in 2021 has dropped (-8 points) from the previous year. At the same time, fewer people report having disability coverage either through their workplace benefits (-6 points) or an individual disability plan (-9 points) – something which can help replace lost income should someone be unable to work for an extended period.

“The number of Canadians with disability coverage has declined from the peak of the pandemic to today,” adds Winslow. “But as mental health challenges continue to rise and the future remains uncertain, it’s more important than ever for all Canadians to consider their options for financial protection.”

Canadians should consider these three tips to help manage stress and maintain good mental health:

To learn more, visit www.rbcinsurance.com/disability.

These are some of the findings of an Ipsos poll conducted between October 14 to 18, 2021. For this survey, a sample of 1,501 employed Canadians aged 18+ was interviewed. Weighting was then employed to balance demographics to ensure that the sample’s composition reflects that of the population according to Census data and to provide results intended to approximate the sample universe. The precision of Ipsos online polls is measured using a credibility interval. In this case, the poll is accurate to within ±3.1 percentage points, 19 times out of 20. The credibility interval will be wider among subsets of the population. All sample surveys and polls may be subject to other sources of error, including, but not limited to coverage error, and measurement error.

RBC Insurance® offers a wide range of life, health, home, auto, travel, wealth and reinsurance advice and solutions, as well as creditor and business insurance services to individual, business and group clients. RBC Insurance is the brand name for the insurance operating entities of Royal Bank of Canada, one of North America’s leading diversified financial services companies. RBC Insurance is among the largest Canadian bank-owned insurance organizations, with approximately 2,500 employees who serve more than four million clients globally. For more information, please visit www.rbcinsurance.com.

Kiara Famularo, RBC Corporate Communications, 647-272-4077

Share This Article

Whatever You Need, We Can Help

Speak with an RBC Insurance Advisor: 1-888-925-0946 or Have an Advisor Call Me

Want to meet? Find an Advisor or Store