The Five Big Questions You Need to Ask About Your Workplace Disability Insurance Coverage

By Alexandra Macqueen, CFP® • Published December 4, 2022 • 7 Min Read

You need your pay cheque to pay your bills, do your extra-curricular activities, eat and so much more, so what happens if you suddenly become sick or injured and can’t work? If you’re a full-time employee, your benefits plan may provide some financial protection, in the form of disability insurance. You could even call disability insurance “Income replacement insurance” because it replaces some of your income if you get sick or injured and cannot work.

But is the coverage you have at work sufficient to meet your needs? We’ll break down disability insurance coverage that’s provided as part of employee benefits, and guide you through how to figure out whether your workplace plan fits your needs.

Many people have short-term or long-term disability insurance coverage, or both, through group insurance provided by an employer.

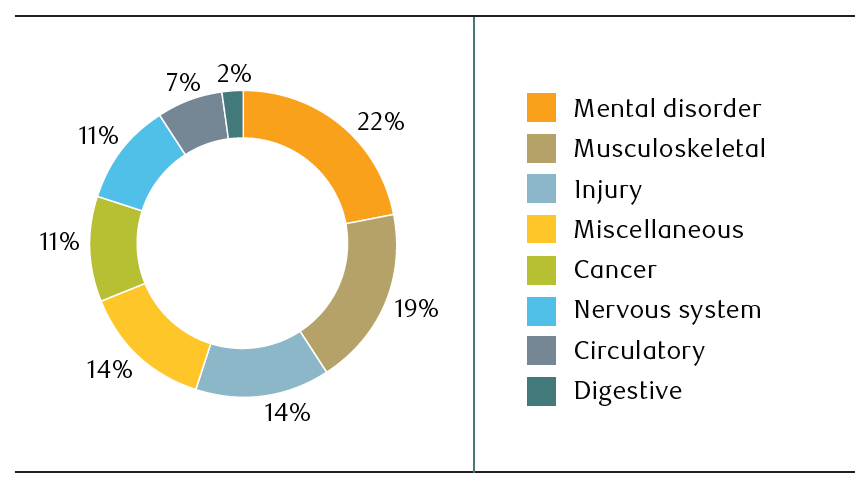

This is an important benefit, as the occurrence of disabilities in Canada might be greater than you think. In 2017, 22 percent of the Canadian population aged 15 years and over – or about 6.2 million people – had one or more disabilities.

*these numbers are based on disability insurance claims received by RBC Life Insurance Company® between 2014 and 2017.

Your benefit (or disability benefit), which is a term you’ll see used quite frequently below, is the payments you receive from your disability insurance policy. Short-term disability insurance policies usually provide benefits immediately and last between three and six months. Long-term policies, on the other hand, usually only provide benefits after a waiting period of one or more months, and then last for a specified period, like two years – or until you reach a specific age, such as 65. Short-term and long-term policies are designed to coordinate so you won’t be left with gaps in coverage.

Both forms of disability insurance provide some income replacement when you can’t work due to a disability, whether that’s from a physical injury, an illness, or a mental health condition. You can think of disability insurance as a form of insurance for your pay cheque, to keep income coming in even if you become disabled and can’t work.

The details of how your insurance coverage protects your income will be set out directly in the policy. Reviewing the policy will tell you:

A policy through work might offer an option to add extra coverage. This is considered a “top up” to your coverage. You might decide to add extra insurance if you find out that the standard monthly amount offered through your employee benefit plan is not enough to cover your monthly expenses.

Take some time to look through your budget so that you know what amount of income you need to have coming in every month to continue to cover your expenses.

Your monthly income from a disability insurance policy will depend on your regular income amount, and how much of that income is replaced by your disability benefit.

Let’s say Sarah, age 34 and living in Ontario, earns $54,000 per year before tax – gross income. That’s $4,500 per month. The income protection policy offered by her employer replaces 60 percent of her salary, before tax, to a maximum of $5,000 per month if she becomes disabled.

If Sarah develops a disabling illness so that she can’t work and is eligible for a monthly disability benefit, she will receive 60 percent of $4,500 – or $2,700 – in monthly income. And because Sarah’s disability benefit of $2700 is less than the monthly maximum of $5,000, she will receive the full benefit for as long as she is eligible.

| Sarah’s salary before taxes: $54,000 | ||

|---|---|---|

| 100% of pay cheque before need of disability benefit | 60% of pay cheque with disability benefit | |

| Monthly income before tax: | $4,500 | $2,700* |

*The $2700 benefit may or may not get taxed. That is dependent on whether Sarah pays the cost for her group disability coverage or if her employer pays. This will be discussed further below.

Do you know what percentage of your gross salary your employer disability insurance policy will cover? Do you know what the maximum per month benefit amount is? These are important questions to find out from your HR department or group plan administrator.

Often, employers will set up their employee benefits plan so the employee pays the full monthly cost for disability insurance. That’s usually because, if you pay, and not your employer, your disability benefits will be tax-free. This means your income while on disability would be closer to your take-home pay.

In contrast, if your employer pays for the cost of your disability insurance, you’d need to pay tax on your monthly disability benefit.

Do you pay for your disability insurance through work or does your employer? Will you be taxed on your employer disability benefit? This is an important question to ask your HR department or group plan administrator so you have the accurate monthly benefit amount for your budget calculations.

An important part of this puzzle to understand is how much of your after-tax income to you rely on to cover all your monthly expenses?

Note that if Sarah’s annual income was higher, her regular monthly income might already be above the maximum dollar amount her benefit will pay. This can put her at a disadvantage.

For example, if Sarah earned $120,000 gross per year, or around $10,000 per month before taxes, her disability coverage would only pay a maximum of $5,000 of monthly income – or 50 percent, not 60 percent, of her salary.

If this was Sarah’s situation, she might decide to purchase additional disability insurance, either through her employer or on her own.

Whether or not you have income protection as an employee benefit, you can also buy personal individual disability insurance from a broker or directly with an insurance company.

This way, you can get customized coverage for your needs, and you can choose the level and type of benefit you want. For example, after a specified period of receiving full benefits, most employer-provided disability insurance policies might may pay you only if you are unable to work in any capacity. In comparison, an individual policy might continue to pay for as long as you are unable to work at your own job.

Keep in mind, as well, that your employer-provided disability coverage is linked to your work, so if you stop working for that employer, your protection will end.

It’s important to take the time to ask your employer or HR department about the coverage you have. Once you have clarity about the kind of coverage you have in place, and you’ve calculated how much of your income you’ll need to have coming in to pay your monthly expenses, you’ll be in a position to make an informed choice about whether your existing coverage is enough.

Learn more about personal disability insurance.

Help ensure your expenses are covered if you get sick or injured

*Home and auto insurance products are distributed by RBC Insurance Agency Ltd. and underwritten by Aviva General Insurance Company. In Quebec, RBC Insurance Agency Ltd. Is registered as a damage insurance agency. As a result of government-run auto insurance plans, auto insurance is not available through RBC Insurance in Manitoba, Saskatchewan and British Columbia.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Share This Article

Read This Next

Speak with an RBC Insurance Advisor: 1-888-925-0946 or Have an Advisor Call Me

Want to meet? Find an Advisor or Store